Forex firms, also known as foreign exchange firms, play a pivotal role in the global currency exchange market. They act as intermediaries that facilitate the buying and selling of currencies, allowing traders and investors to capitalize on fluctuations in exchange rates. These firms offer a variety of services, including currency conversion, forex trading accounts, and access to trading platforms. Additionally, they provide value-added services such as market analysis, trading signals, and educational resources to help clients make informed decisions.

One of the primary functions of forex firms is the listing and updating of forex rates. Forex rates, or exchange rates, represent the value of one currency in terms of another. These rates are not static and can change rapidly due to a myriad of factors. Economic indicators, such as inflation rates, interest rates, and gross domestic product (GDP) figures, significantly influence forex rates. Political stability and market speculation also play crucial roles. For instance, a country experiencing political unrest or policy changes may see its currency value fluctuate as investors react to the uncertainty.

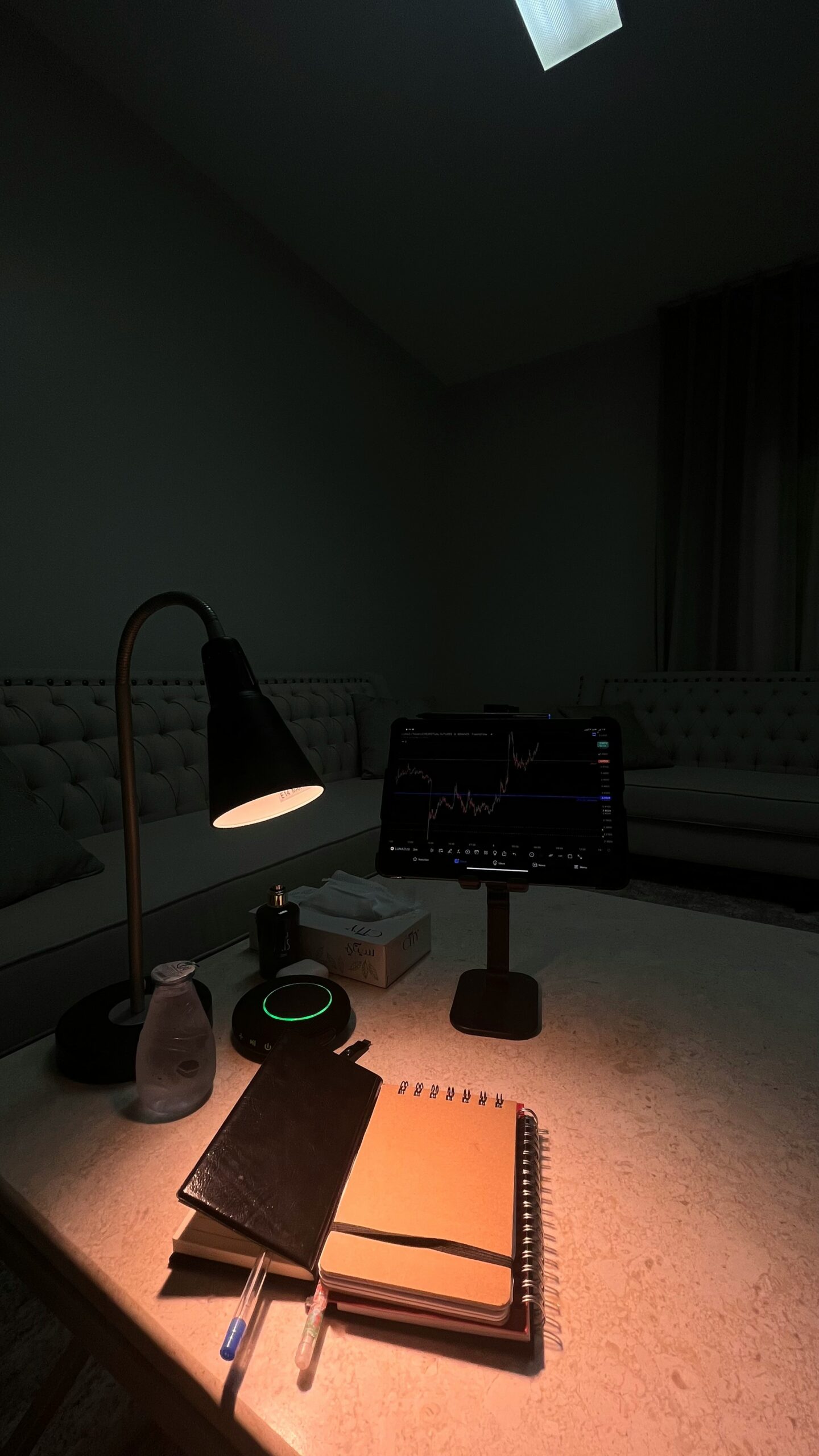

Forex firms utilize various platforms and tools to track and list forex rates. These include proprietary trading platforms, third-party software, and online forex rate aggregators. Real-time tracking of forex rates is essential for traders and investors as it allows them to respond quickly to market movements. Timely access to accurate rate information can mean the difference between profit and loss in the fast-paced world of forex trading.

Choosing a reputable forex firm is crucial for anyone looking to engage in currency trading. A reliable firm not only provides competitive rates and robust trading platforms but also ensures the security of clients’ funds and personal information. It is advisable to research and select a forex firm that is regulated by recognized financial authorities and has a track record of transparency and integrity in its operations.

In summary, forex firms are integral to the global currency exchange market, offering vital services and tools needed for successful trading. Understanding how forex rates are determined and the importance of real-time tracking can empower traders and investors to make more informed decisions, ultimately enhancing their trading outcomes.

Building Custom Portfolios and Tracking with Compact News on Forex

Creating a custom forex portfolio requires a thorough understanding of individual investment goals and risk profiles. The first step in building a tailored portfolio is the selection of appropriate currency pairs. Investors should consider both major and minor pairs, analyzing historical performance, volatility, and correlation to diversify effectively. A well-diversified portfolio reduces the risk associated with fluctuations in the forex market, as it spreads exposure across multiple currencies.

Diversification strategies play a crucial role in portfolio management. By including a mix of currencies from different regions, investors can mitigate the impact of local economic downturns. Moreover, integrating financial analysis tools such as technical indicators and fundamental analysis can aid in making informed decisions. Tools like Relative Strength Index (RSI), Moving Averages, and Economic Calendars provide insights into market trends and potential entry or exit points.

Continuous monitoring and adjustment of the portfolio are essential to responding to market changes. The forex market is highly dynamic, with rates affected by a myriad of factors including economic data releases, central bank policies, and geopolitical events. Regular portfolio reviews allow traders to realign their investments with evolving market conditions, ensuring that their strategies remain effective.

Real-time news updates are indispensable in forex trading. Traders can leverage compact news feeds to stay informed about market movements, economic events, and geopolitical developments. Reliable sources like financial news websites, dedicated forex news portals, and real-time alerts from trading platforms can provide timely information. Integrating these updates into trading strategies can significantly enhance decision-making processes.

For instance, a sudden change in interest rates announced by a central bank or unexpected geopolitical tension can cause substantial market shifts. By staying informed, traders can quickly adjust their positions to capitalize on new opportunities or mitigate potential losses. Ultimately, the synergy between custom portfolio building and real-time news tracking enables traders to navigate the complex forex landscape more effectively, optimizing their portfolio performance.