“`html

Understanding Forex Rates and Their Listing

Forex rates, or foreign exchange rates, are the prices at which one currency can be exchanged for another. These rates are typically listed in pairs, such as EUR/USD or GBP/JPY, signifying the value of one currency, known as the base currency, relative to another, known as the quote currency. Understanding the dynamics of these pairs is crucial for any forex trader.

The base currency is the first in the pair and the quote currency is the second. For instance, in the EUR/USD pair, the euro is the base currency and the US dollar is the quote currency. The forex rate represents how much of the quote currency is needed to purchase one unit of the base currency. Several factors influence these rates, including geopolitical events, economic indicators like GDP, inflation rates, and unemployment figures, and overall market sentiment.

Forex firms list their rates on various platforms, and the accuracy and timeliness of this information are critical for traders. Real-time data is essential as forex markets can be highly volatile, with rates fluctuating rapidly in response to global news and events. The bid/ask spread, the difference between the buying price (bid) and the selling price (ask), also plays a significant role, impacting the potential profits and losses of trades.

A key distinction in forex trading is between fixed and floating exchange rates. Fixed rates are pegged by governments to another currency or a basket of currencies, while floating rates are determined by market forces. Each system has its advantages and drawbacks, influencing a trader’s strategy.

To make informed trading decisions, traders utilize various tools to compare rates from different forex firms. These tools include rate comparison charts, economic calendars, and trading platforms offering real-time data. By effectively analyzing this information, traders can optimize their strategies and potentially enhance their trading outcomes.

Creating a Custom Forex Portfolio and Tracking with Real-Time News

Developing a custom forex portfolio is a crucial step for traders aiming to align their investments with specific trading goals and risk tolerance. A well-constructed portfolio should be diversified to mitigate risks, which involves selecting a balanced mix of currency pairs. Diversification helps in reducing the impact of adverse movements in a single currency by spreading the risk across multiple currencies. Therefore, picking the right currency pairs based on economic indicators, geopolitical stability, and historical performance is essential for creating a robust portfolio.

Adjusting the portfolio based on market conditions is another vital aspect of forex trading. Market conditions are dynamic, and regular reassessment and rebalancing of the portfolio can help in maintaining its alignment with the trader’s objectives. Traders should consider factors such as changes in economic policies, interest rate fluctuations, and emerging political situations. This proactive approach ensures that the portfolio remains resilient and responsive to the ever-changing forex market landscape.

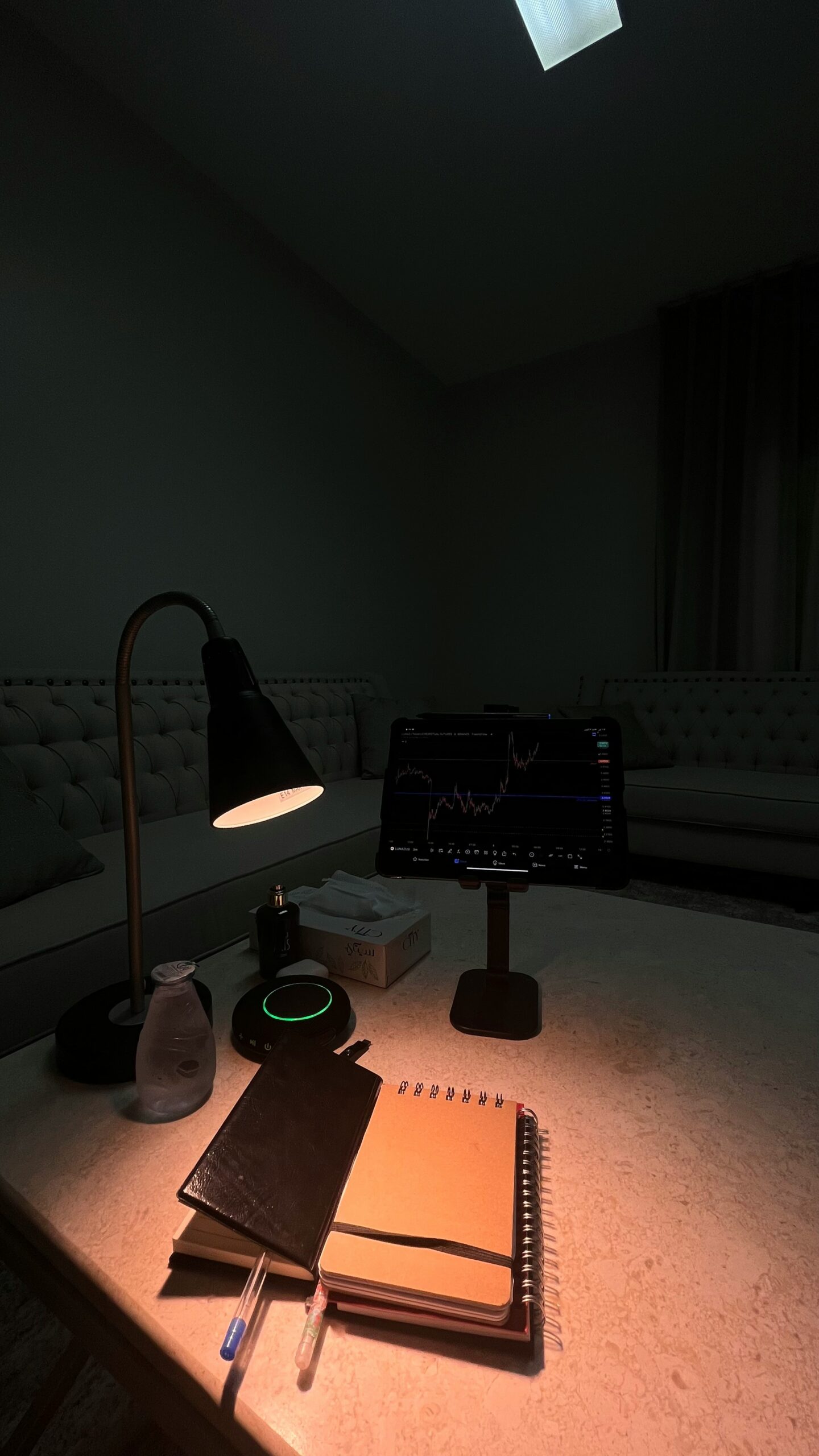

Monitoring the performance of a custom forex portfolio requires the use of various tracking tools and platforms. Modern trading platforms offer real-time tracking features, allowing traders to keep a close watch on their investments. These tools provide insights into metrics such as portfolio valuation, profit and loss, and individual currency pair performance, thereby enabling informed decision-making. Additionally, setting up alerts for specific market conditions or price levels can aid in timely interventions.

Staying updated with real-time news is indispensable for forex traders. News related to forex can significantly influence currency movements, making it imperative to filter and interpret such information effectively. Major global events, such as economic reports, central bank announcements, and geopolitical developments, can have profound impacts on currency prices. Reliable sources for obtaining timely forex news include financial news websites, forex news aggregators, and specialized financial news channels.

Integrating news updates into trading strategies enhances decision-making capabilities. Traders can use news to identify potential trading opportunities or avoid unfavorable market conditions. For instance, understanding the implications of an interest rate hike by a central bank on a currency’s value can help traders make strategic adjustments to their portfolios. Utilizing real-time news effectively, in conjunction with a well-diversified forex portfolio, can significantly improve trading outcomes.